I’m Jay Kent, managing director of SLB Performance, a consulting firm that helps companies reduce supply chain costs, implement BI tools, and improve in-stock and customer service. After 25 years of leading some of the most complex supply chains in the industry, I began advising companies in multiple industries and verticals. It’s important to understand the market to mitigate costs and improve efficiencies. So, twice a month, I’ll share parcel news and thoughts. Be sure to hit the subscribe button to receive the latest newsletter in your LinkedIn notifications.

Buckle up for a new year that will bring higher parcel shipping costs for shippers and layoffs for FedEx and UPS as the two carriers adjust to lower volumes.

2024 General rate increases (GRI) are now in effect for FedEx, UPS, and other carriers. Higher USPS ratesgo into effect on January 21.

But wait…there’s more – UPS announced that it’s extending Demand Surcharges to Additional Handling and Large Packages, effective January 14 until “further notice” But, as Shipware noted in a LinkedIn post, UPS has not announced an extension to demand surcharges on SurePost, Ground Residential, and Air Residential shipments…yet.

Meanwhile, FedEx’s demand surcharge extensionwill become effective on January 15.

Shutting Down Parcel Shifts

As both carriers extend their “demand surcharges,” volumes continue to decline, and layoffs are underway at facilities. UPS is cutting a package sortation shiftat an Indianapolis facility on Feb. 16. It joins UPS’ Centennial ground hub in Louisville, Kentucky, which is closing its day sort operations in February. Package sorting operations are being reduced “at a few UPS facilities” overall, UPS spokesperson Jim Mayer said in an email to Supply Chain Dive. “We often evaluate our operations and flex our network to meet volume demands. This allows us to continue delivering industry-leading service while also maintaining competitive prices.”

Employment

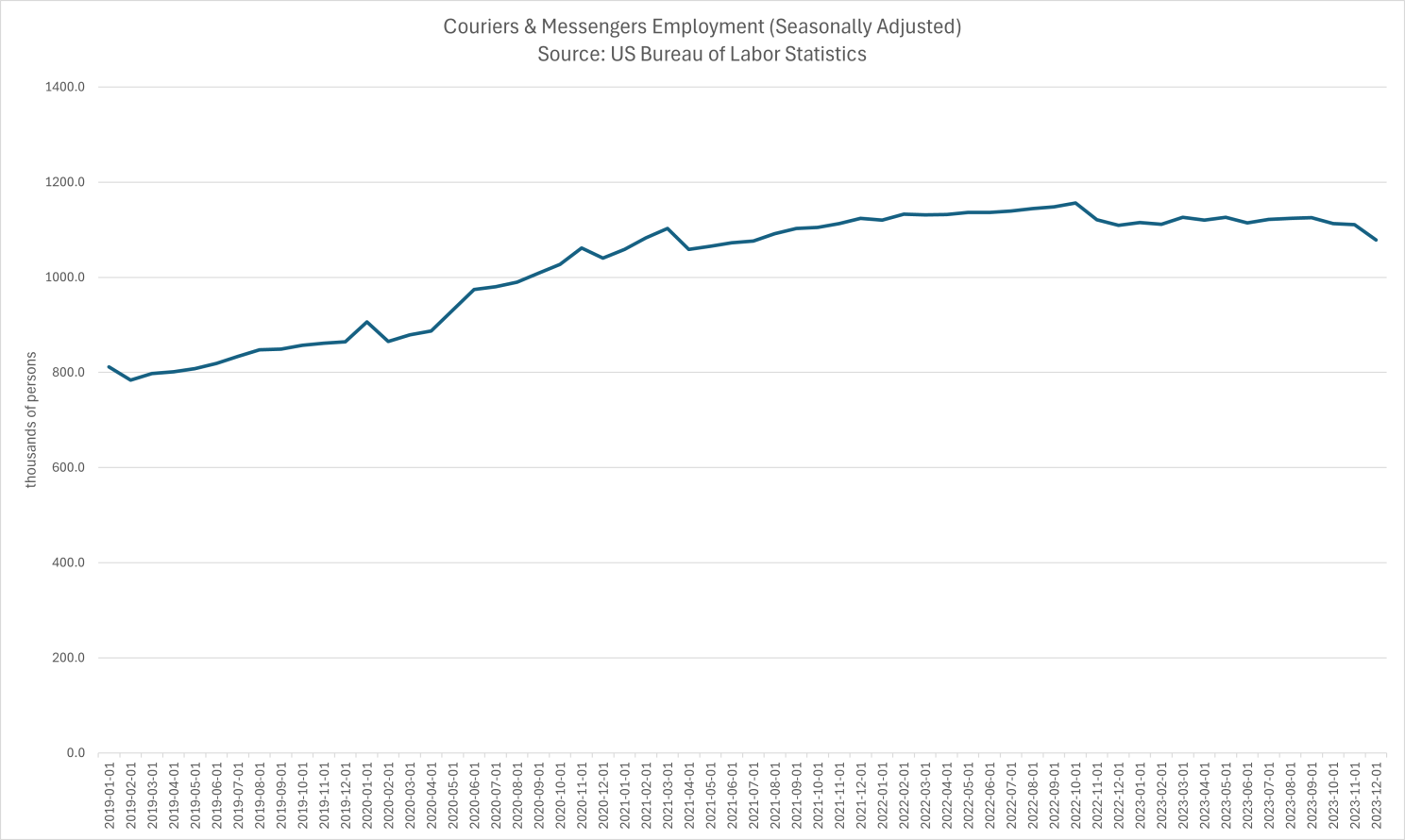

Courier & Messenger employment continues to normalize from pandemic-highs. Last week’s US employment report from the US Bureau of Labor Statistics (BLS) showed, on a seasonally adjusted basis, that for December, courier & messenger employment declined 2.8% compared to December 2022; down 4.0% from 2021 but up 3.6% from 2020 and up 24.7% from 2019.

For the year, couriers & messenger employment declined 1.6% from 2022 but remains up 2.6% for 2021, up 15.9% from 2020 and up 34.8% from 2019, so expect more declines this year as the market continues to adjust to lower volumes.

FedEx Express Troubles

- According to a FreightWaves story, FedEx Corp. expects its air express unit will lose half of its business with the U.S. Postal Service when the contract expires in September. Postal delivery at 29 daytime cities where FedEx flies domestically is in jeopardy of being eliminated at the end of the government’s fiscal year, Pat DiMento, FedEx’s vice president of flight operations and training, warned in a recent meeting with a group of supervisory pilots. The loss of a substantial portion of Postal Service work means FedEx will have 200 to 300 more excess pilots by October, said the flight operations chief. The cargo airline plans to lower guaranteed flight hours for pilots and offer early retirement packages because it already has hundreds of surplus pilots with the shipping market in a prolonged downturn.

- FedEx Pilot representatives have expressed their disappointment at the latest round of talks over a new contract while labeling an offer to move to a regional airline as insulting, according to an Air Cargo News story. Billy Wilson, chair of the FedEx ALPA master executive council (MEC), said: “Everything attributed to FedEx management in a recent media piece has been used before to excuse a plodding pace at the bargaining table and overall failure to recognize the value of FedEx pilots. It should be clear by now that we aren’t buying it, and I’m proud to say that our leadership and negotiating team are holding the line.”

In Other News

- Canada Post sells 3PL SCI Group to Montréal-based Metro Supply Chain. “SCI has been a strong performer for the Canada Post Group of Companies over the years,” said Doug Ettinger, President and CEO of Canada Post. “We’re pleased this move will help to further strengthen an established Canadian logistics leader while allowing us to focus our efforts on continuing to lead in the rapidly growing e-commerce market.”

- OneRail has partnered with GoShare. GoShare is available in over 65 major metropolitan areas nationwide and specializes in transporting big and bulky cargo, LTL shipments, and small parcel delivery. OneRail’s platform automates last-mile logistics by intelligently matching the most efficient shipping mode and carrier from its network to optimize every order and achieve 98% on-time delivery.

- Flowspace, a software platform and distribution network for fulfillment, announced a nationwide partnership with Two Boxesto enhance reverse logistics capabilities for merchants contending with more than $80B in post-holiday returns and exchanges.

That’s it for now. Comments are always welcome. Reach out if you’d like to learn how to lower or even possibly eliminate any parcel fees. Stay tuned for the next newsletter on January 24, and don’t forget to hit the subscribe button to ensure you receive it in your LinkedIn notices.

-Jay